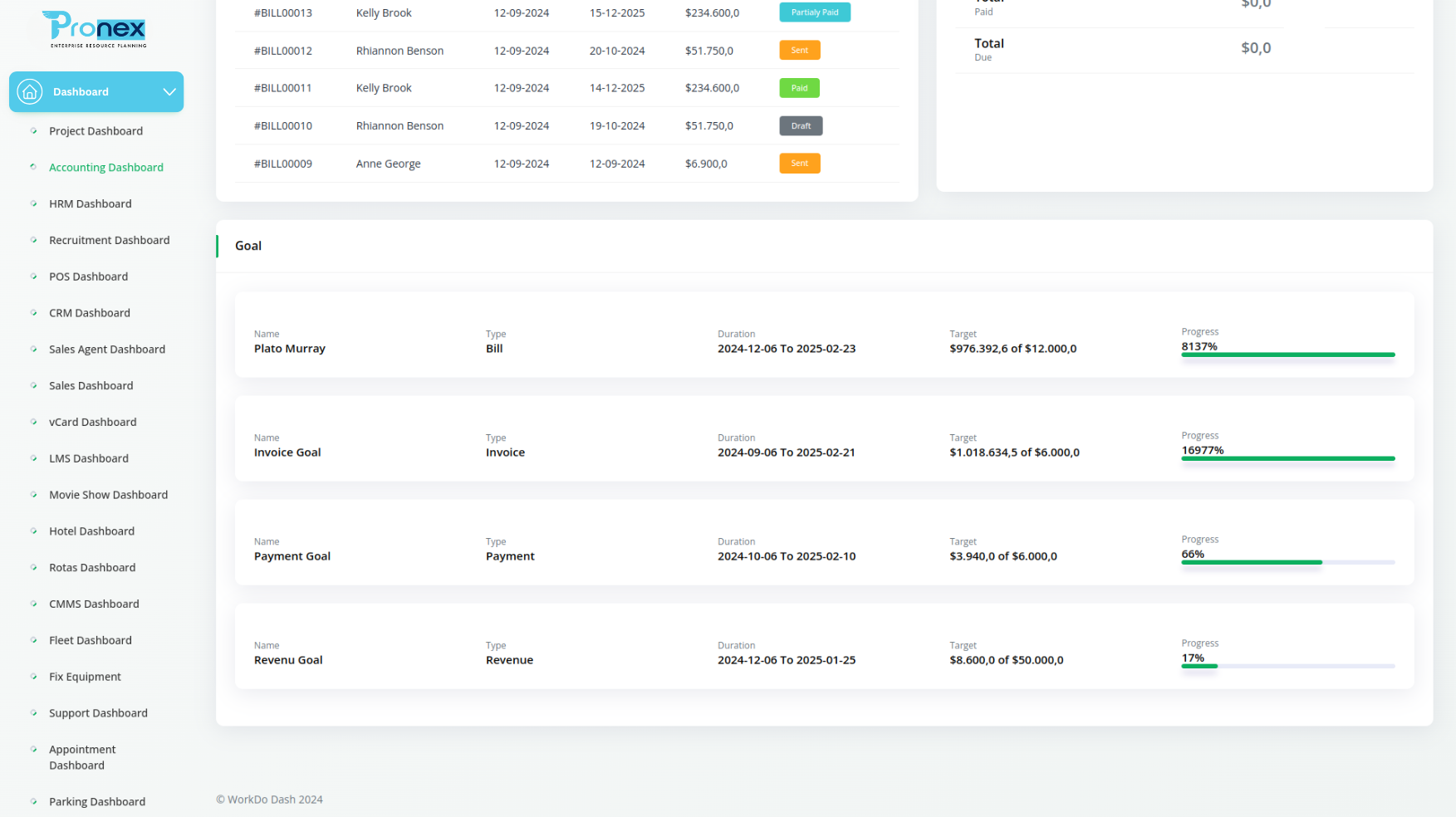

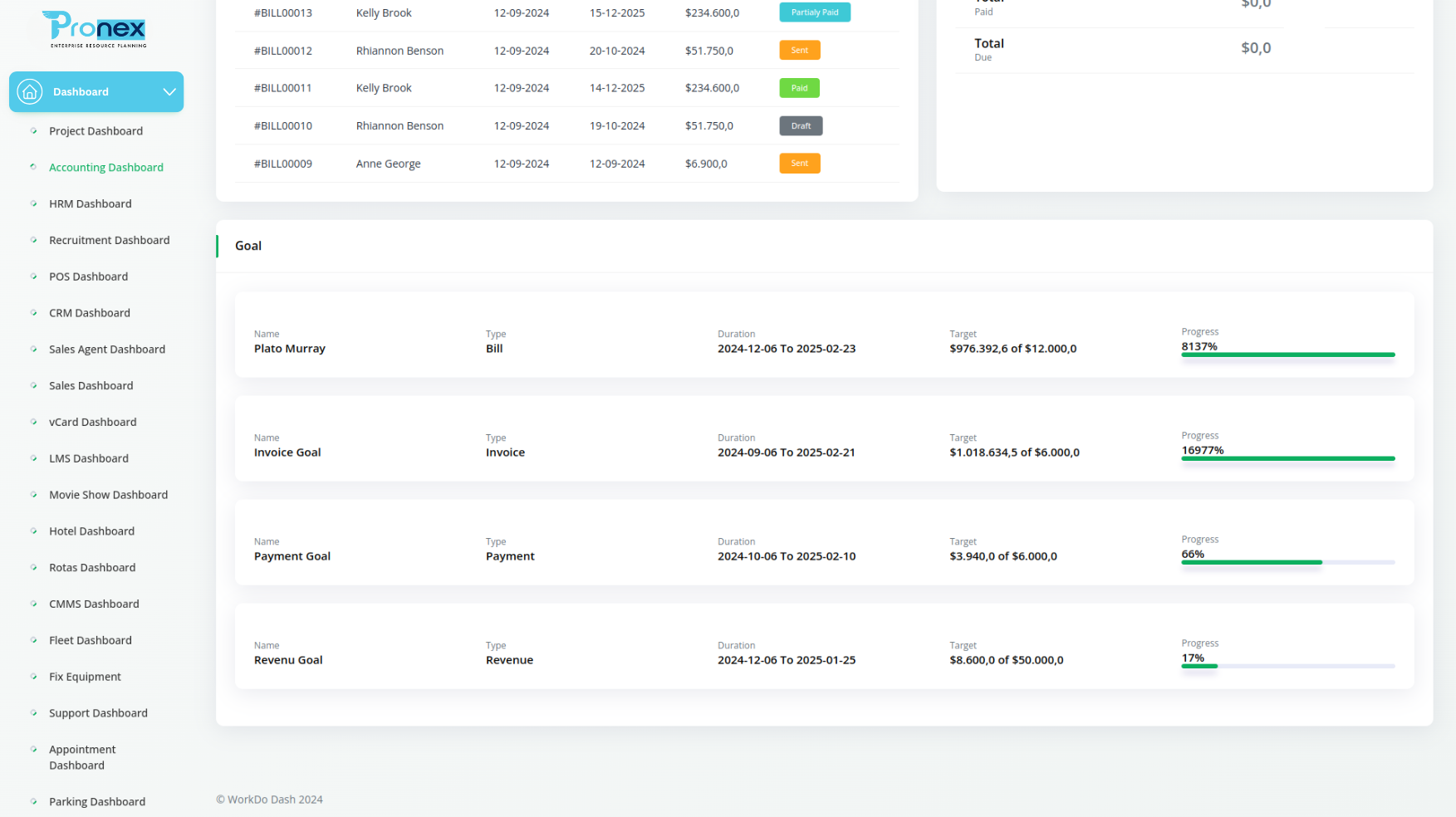

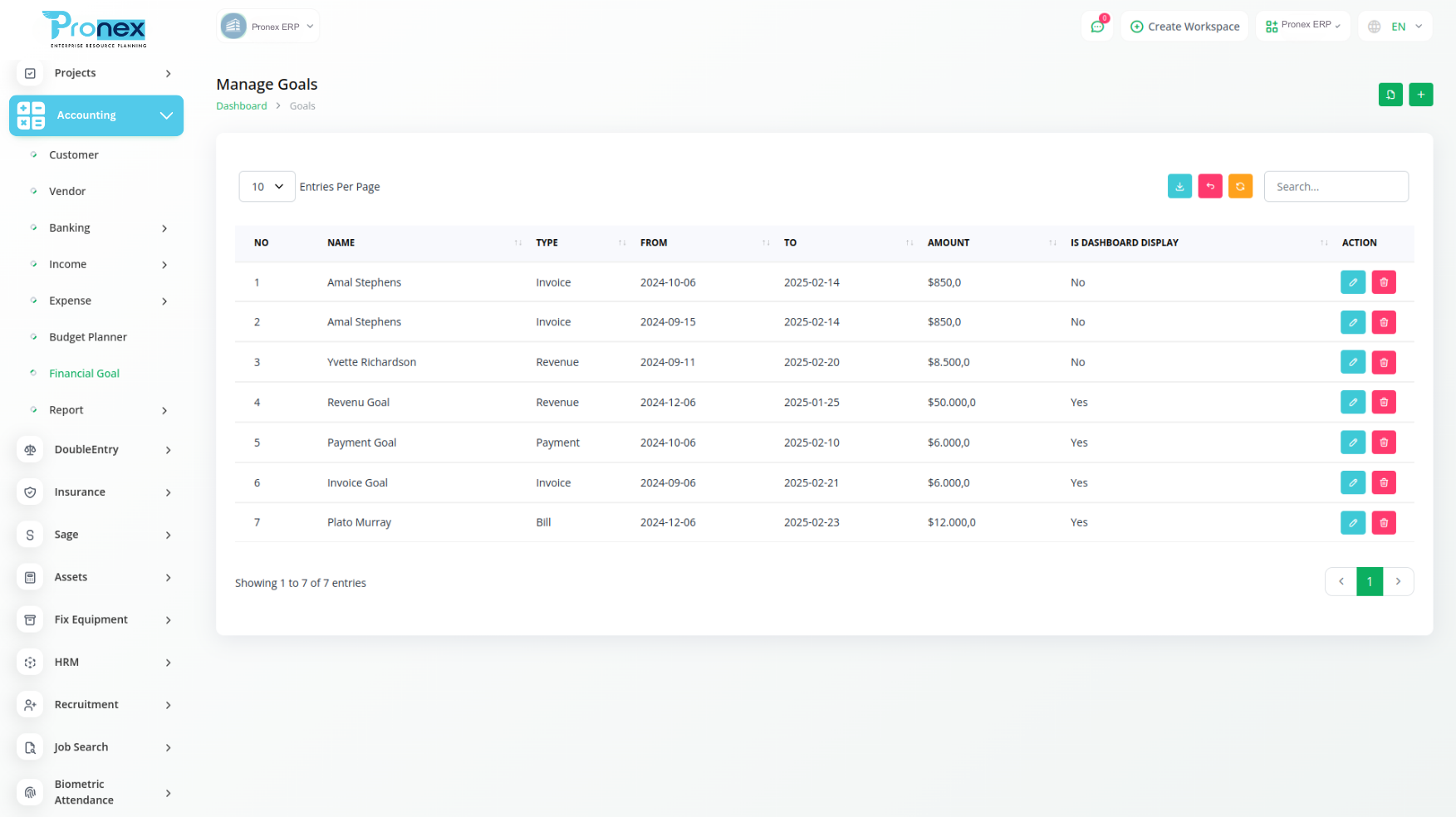

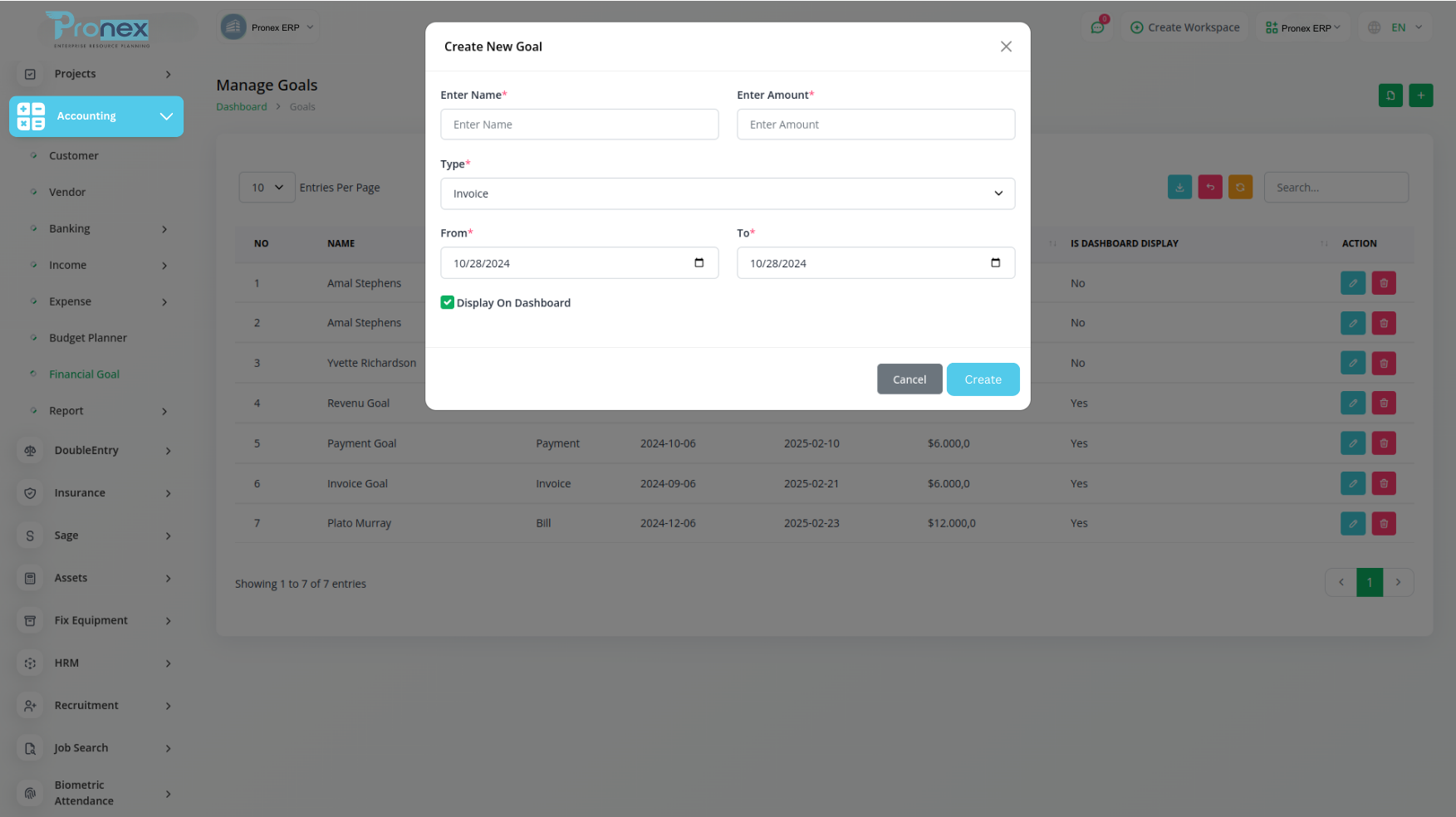

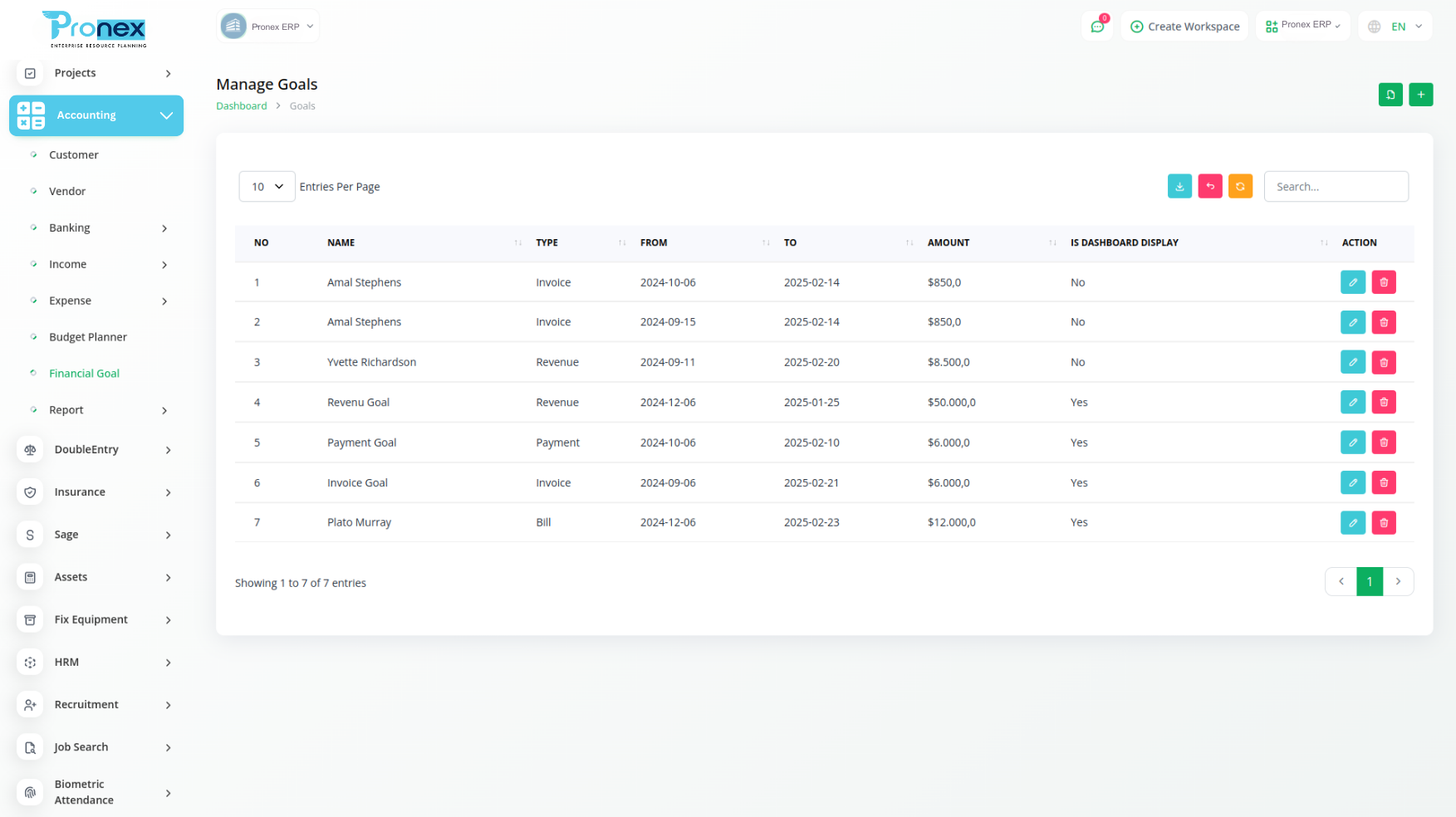

Financial Goal

Define and monitor financial and business goals, track progress, refine strategies, and drive growth, All powered by the Account Module.

Setting Financial Goals for Better Money Management

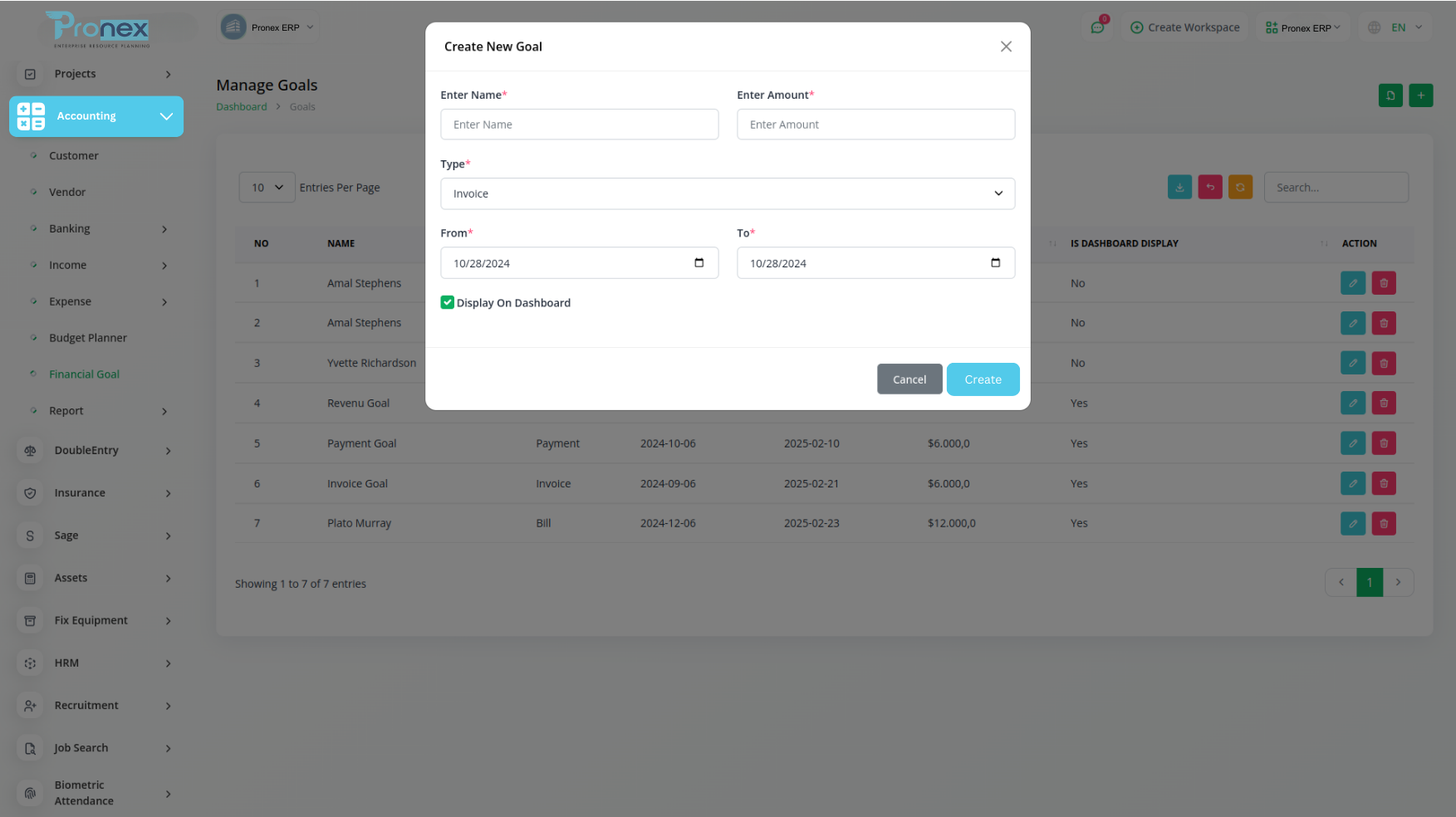

A financial goal is a target for managing money, including saving, spending, earning, or investing. Setting financial goals is essential for effective budgeting.

What Are Financial Goals?

Financial goals are specific targets you set for managing your money, including saving, spending, earning, and investing. They help guide financial decisions and are essential for creating a successful budget.

Financial goals are the perFinancial goals are personal, long-term or short-term objectives for saving and spending money. Defining them in advance helps you stay focused and achieve them more easily.onal, big-picture objectives you set for how you’ll save and spend money. They can be things you hope to achieve in the short term or further down the road. Either way, it’s often easier to reach your goals if you identify them in advance.

Consider what matters most to you when setting financial goals. It's natural to have multiple goals, and they may evolve over time.

Setting financial goals helps shape your future by guiding your present actions. For example, if your goal is to pay off a large credit card bill, you might reduce takeout expenses and use the savings for extra payments. Without a clear goal, overspending can continue, leading to increasing debt.

Types of Financial Goals

While financial goals can vary, categorizing them by time frame helps clarify priorities and maintain focus. Setting clear timelines ensures better planning and keeps you on track. Here are three types of financial goals:

- Short-Term Goals – Achievable within a few months to a year.

- Medium-Term Goals – Typically take one to five years to accomplish.

- Long-Term Goals – Require five or more years to reach and often involve major financial milestones.

Breaking goals into these categories helps you stay organized and work toward them effectively.

Why opt for dedicated modules for your business?

With Pronex ERP, effortlessly oversee all your business functions from one central platform.

Boost Productivity and Efficiency with Pronex ERP

Get Premium Add-ons for Accounting, HR, Payments, Leads, Communication, Management, and more. All in one place!

- Pay-as-you-go

- Unlimited installation

- Secure cloud storage

Why choose specialized modulesfor your business?

Manage all your business functions seamlessly from a single platform with Pronex ERP.